WELCOME TO OMBA

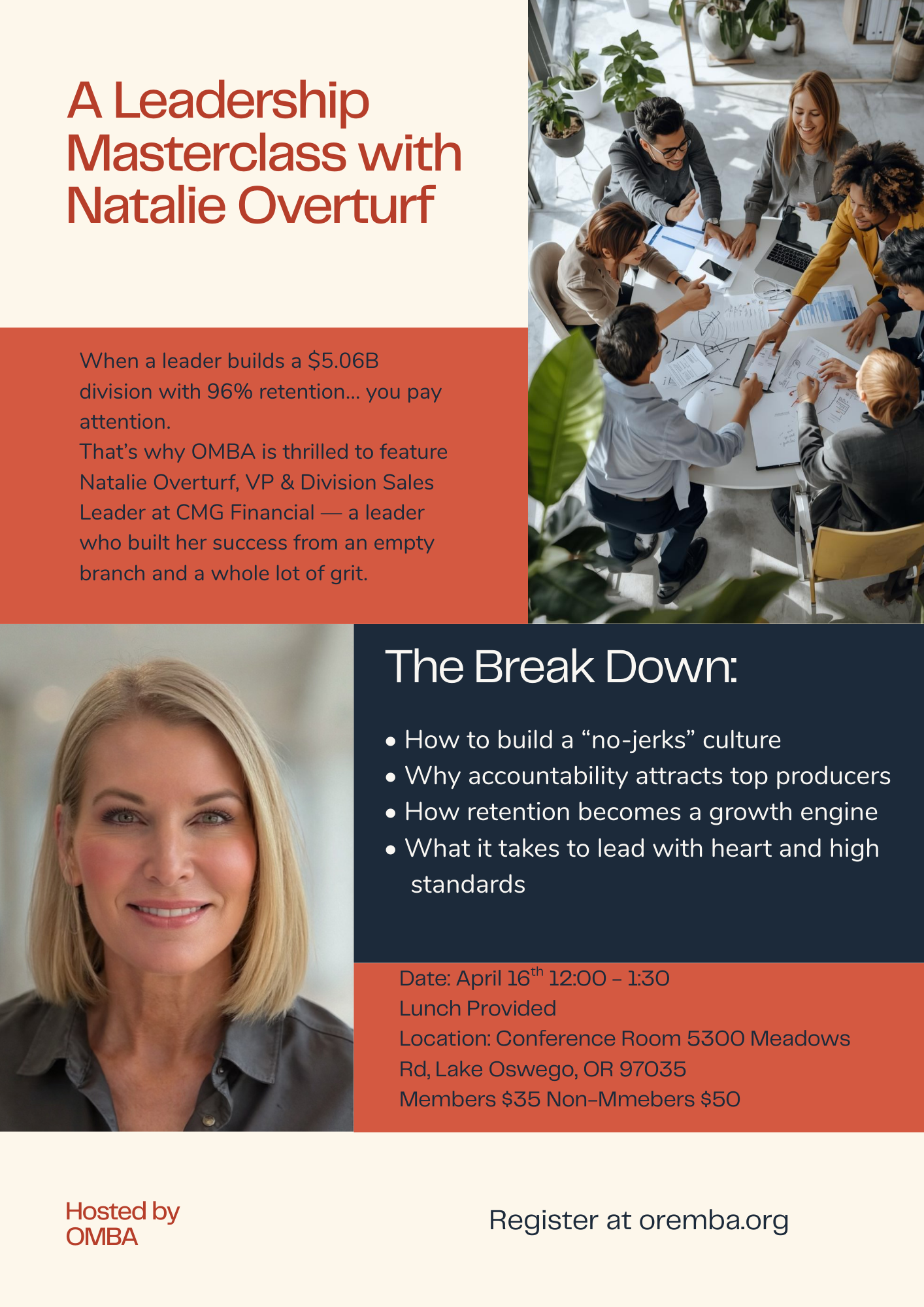

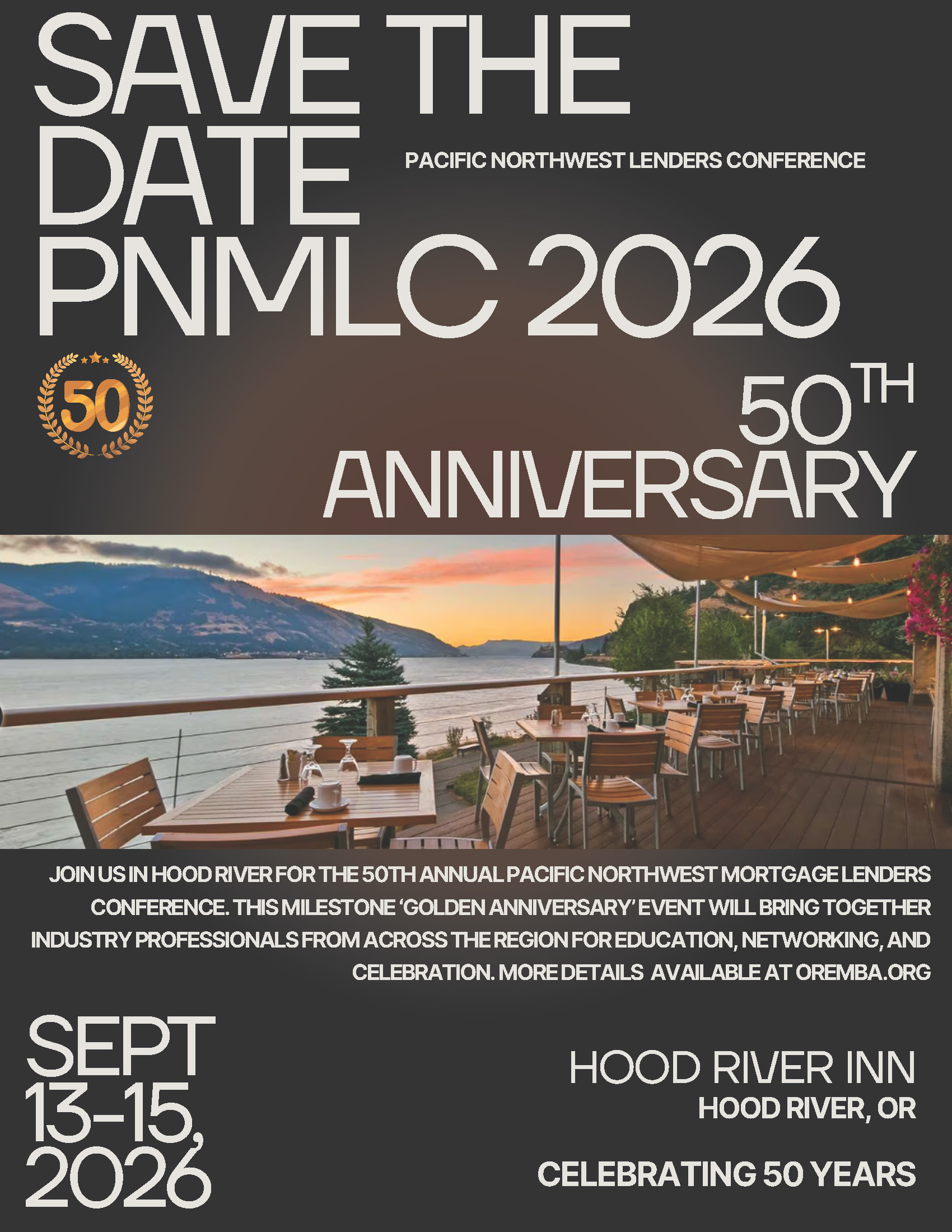

| Upcoming Signature Events |

|

|

|

|

The Benefits of Membership

- Networking & Education

- Connection with coworkers and peers

- Advocacy

- Timely source of industry updates

- Community involvement & philanthropy

Community Involvement

The Oregon Mortgage Bankers Association coordinates events throughout the year that sell raffle tickets and other items with all proceeds are donated to Habitat for Humanity. From 2023 Golf Tournament, OMBA donated $1,385 to Habitat for Humanity and hosted a Volunteer Build Day with Habitat for Humanity in Bend. The Oregon Mortgage Bankers Association coordinates events throughout the year that sell raffle tickets and other items with all proceeds are donated to Habitat for Humanity. From 2023 Golf Tournament, OMBA donated $1,385 to Habitat for Humanity and hosted a Volunteer Build Day with Habitat for Humanity in Bend.

|